A mortgage CRM is a system designed to make it easier for you to manage your customers and finances. The main goal is to make the process of managing your clients’ mortgages more efficient, allowing you to focus on other aspects of running your business. With a mortgage CRM, you will have access to all the information about your customers at your fingertips.

Here are some ways that a mortgage CRM can help you be more productive and achieve success in your mortgage business.

Why use a mortgage CRM?

If you are a mortgage broker, and you have multiple customers on your plate at any given time, a mortgage CRM is able to help you stay organized. With this type of software, you can store all of the information about your customers in one place- their contact information, loan application, and more. This way, when they call or email with questions or concerns they will be answered in a timely manner.

What should you look for in a mortgage CRM?

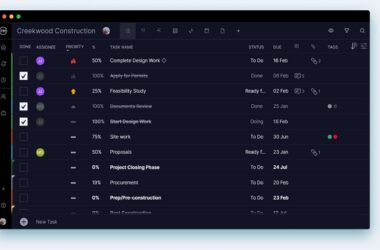

The first thing to look for in a mortgage CRM is what features it includes. It’s important that the system you choose has all the features your organization needs. If you are looking for a CRM that integrates with other systems, this is an excellent feature to have. For example, if your team members rely heavily on Microsoft Outlook, then it would be smarter to have a CRM that integrates with Outlook.

Another feature worth looking into is whether or not the CRM offers mobile capabilities. Mobile CRMs are powerful tools when it comes to customer service and lead management as they allow you to access information as soon as it happens without having to be at your desk. You should also consider how easy the system is to use, who will work on it, and how much training is necessary before getting started.

Important features of good mortgage CRMs

A mortgage CRM system should have a few important features. All CRMs come with these features, but not all of them have the same number of features.

- User friendly: The best CRMs are user-friendly and easy to use. If a customer is having trouble navigating the system, it will be much more difficult for you to use it as well.

- Integrated: It’s essential that your CRM integrates with other software your business uses so that you don’t have to enter the same information multiple times. You’ll save time and increase efficiency by using a CRM that integrates into your current systems.

- Mobile app: A good mortgage CRM should offer a mobile app so you can access your data from anywhere at any time. This is especially helpful when you’re on the road or out of the office for meetings and want to check in with things back at the office without having to take care of it yourself.

- Customer support: Look for a company that offers customer support in case you need help troubleshooting any problems or have questions about how to use their software.

How to integrate your current systems with your new CRM

There are many different ways to integrate your mortgage CRM with your current systems. If you are using a different software for marketing and accounting, this might not be necessary. However, it is still important to have access to all of your customer information on one central system. You don’t want to have to go through multiple programs just to contact a client and you don’t want to miss any important updates about your client’s finances or records.

Conclusion

A good mortgage CRM can help you keep track of your customers, manage your leads and stay up to date with your mortgage business. You’ve come this far—don’t let your mortgage business suffer due to a lack of an essential CRM. After doing a little research, you should be able to find the right one for your needs!